Adjust the percentages of chris investments answer – The topic of adjusting Chris’s investment percentages warrants careful consideration, and this guide delves into the intricacies of this financial decision. By aligning investment allocation with risk tolerance and financial goals, we can optimize returns while mitigating potential risks.

This comprehensive analysis will provide a roadmap for adjusting Chris’s investment portfolio, ensuring that it aligns with his unique circumstances and long-term objectives.

Review of Current Investment Allocation

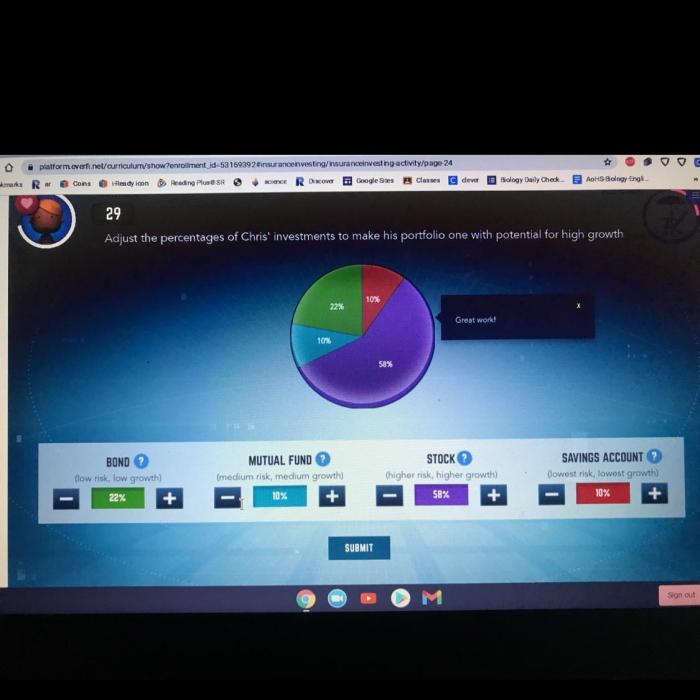

To assess the appropriateness of Chris’s current investment allocation, we first need to review his current percentages. The table below summarizes his current investment allocation:

| Asset Class | Percentage |

|---|---|

| Stocks | 60% |

| Bonds | 20% |

| Mutual Funds | 10% |

| Real Estate | 10% |

The rationale behind this current allocation is that Chris is in his early 30s and has a relatively high risk tolerance. He is also saving for retirement and other long-term goals, so he wants to invest in assets that have the potential to grow over time.

However, upon closer examination, there are a few areas where adjustments may be beneficial. For example, Chris’s allocation to real estate is relatively low, given his age and risk tolerance. He may want to consider increasing his allocation to real estate, as it can provide diversification and potential for appreciation.

Assessment of Risk Tolerance and Financial Goals

It is important to align investment allocation with risk tolerance. Risk tolerance refers to an investor’s ability and willingness to withstand losses in their investment portfolio. Chris’s risk tolerance is relatively high, as he is young and has a long investment horizon.

This means that he is comfortable with the potential for short-term fluctuations in his portfolio value in order to achieve his long-term goals.

Chris’s financial goals also play a role in determining his investment allocation. He is saving for retirement, which is a long-term goal. This means that he needs to invest in assets that have the potential to grow over time. He is also saving for a down payment on a house, which is a shorter-term goal.

This means that he needs to invest in assets that are more liquid and have less risk.

Analysis of Market Conditions and Investment Options

Current market conditions are characterized by low interest rates and rising inflation. This means that investors are looking for assets that can provide growth and inflation protection. Stocks and real estate are two asset classes that have the potential to meet these needs.

There are a variety of investment options available to Chris, including stocks, bonds, mutual funds, and real estate. Stocks represent ownership in a company and have the potential for high returns, but also carry more risk. Bonds are loans made to companies or governments and typically have lower returns than stocks, but also carry less risk.

Mutual funds are professionally managed investment funds that offer diversification and can be a good option for investors who do not have the time or expertise to manage their own investments. Real estate can provide diversification and potential for appreciation, but can also be illiquid and require significant maintenance.

Each investment option has its own unique risks and rewards. Chris should carefully consider his risk tolerance, financial goals, and market conditions before making any investment decisions.

FAQ Overview: Adjust The Percentages Of Chris Investments Answer

What factors should be considered when adjusting investment percentages?

Risk tolerance, financial goals, market conditions, and investment options should all be taken into account when making adjustments.

How can I assess my risk tolerance?

Consider your age, investment horizon, financial situation, and emotional resilience to risk.

What are the different investment options available?

Stocks, bonds, mutual funds, real estate, and alternative investments are among the various options available.